11/2021

By Josh Hegland and Will Jackson, CFP®

Inflation seems to be on the tip of everyone’s tongue, and something we are dealing with every day. Whether you’re in the market for a new or used car, considering a change in primary residence or buying groceries, pent-up demand coupled with supply chain issues have resulted in increased prices.

The question: Is this permanent or temporary?

“Our asset allocation strategy includes the possibility for inflation,” explains Will Jackson, CFP®, partner, Cahaba Wealth Management.

In March of last year as governments considered the best way to respond to the damaging impact of Covid-19, there was a broad consensus: the economy was in need of major stimulus to stave off another Great Depression. The U.S. Administration acted quickly providing economic stimulus payments, direct aid to businesses, and gave a broad mandate to the Fed to help stem the tide and ensure the economy continued to function.

Because of the uncertain picture on the overall impact of the pandemic, the stimulus efforts have continued with many segments of the economy seeing a swift recovery. Consumers have shown an eagerness to get back to normal, but the availability of willing workers has shown resistance. As the saying goes, “no good deed goes unpunished.”

We can debate to what degree, but overall, it would appear that the stimulus has worked, and resulted in improvements in the consumer’s balance sheets. Unfortunately, this has driven demand higher and resulted in higher inflation.

We are now seeing economic growth levels that are healthier than they were pre-pandemic. Looking forward, investors are asking the question: is inflation temporary or permanent?

The simple answer: No one truly knows what long term impact the trillions of dollars of stimulus will have on the economy. Will interest rates rise, will price increases stick, can spending maintain current levels, and will long-term supply and demand levels return to historical levels?

The impact could be different for each of these subgroups, and to date, all prognosticators have been wrong. What has continued to be true is that having a plan has never been more important. So, what should a person do in this type of environment?

Here are a two important things to keep in mind concerning the impact of your financial plan and portfolio.

1. Stocks have historically been a great hedge against inflation. Since 1928, the U.S. stock market has outpaced inflation by nearly 7%. Earnings and dividends have a real growth rate of 2.1% over the rate of inflation over the same time period. While that might not seem like much, the historical inflation rate over this time frame was 2.9%.

Our approach to asset allocation takes into consideration your risk profile, cash flow needs, and investment time-horizon. Over the long term, having the proper allocation of stocks and fixed income assets will help your portfolio not only withstand the fluctuations of inflation, but grow over time.

2. Our cash flow assumptions for clients assume 3% long-term inflation. While we may not know exactly what the near or long-term inflation rates look like, and have not seen inflation rates over 3% since the 1990’s, our conservative approach and assumptions allow us to plan for periods of high inflation. This conservative approach allows us to tailor a client’s income generation to their spending levels to ensure that we have the proper risk/return characteristic applied to their asset allocation.

For now, the Fed is keeping their long-term inflation target at 2%, and recently indicated they would consider beginning the process of reducing stimulus. Additionally, the Fed indicated that they might potentially raise interest rates prior to their previous stated target of 18 months.

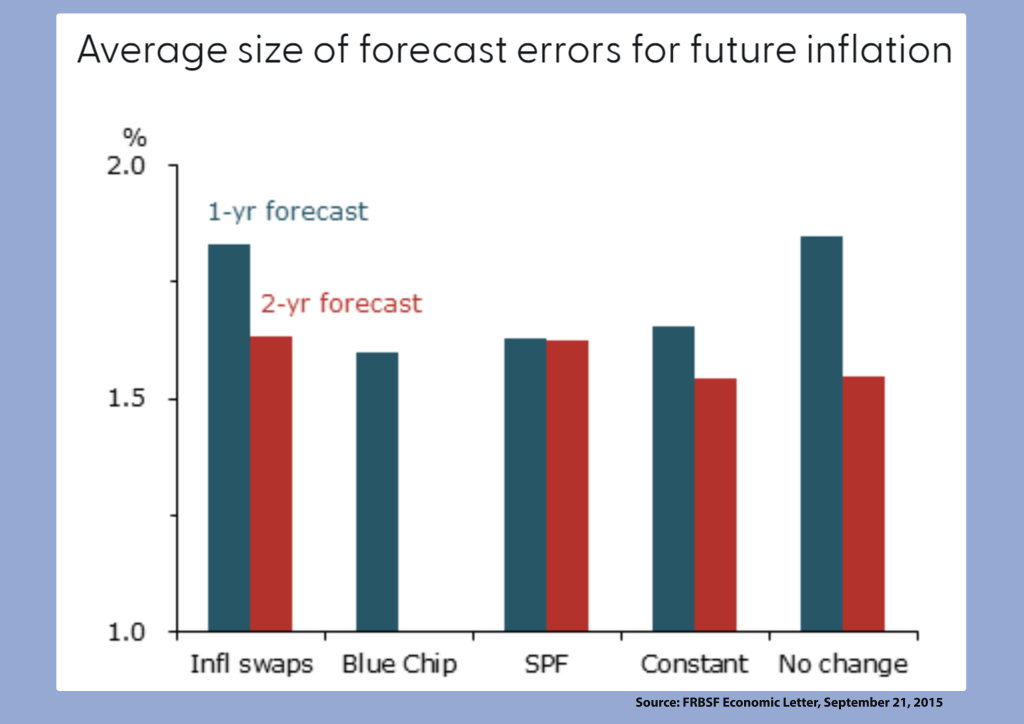

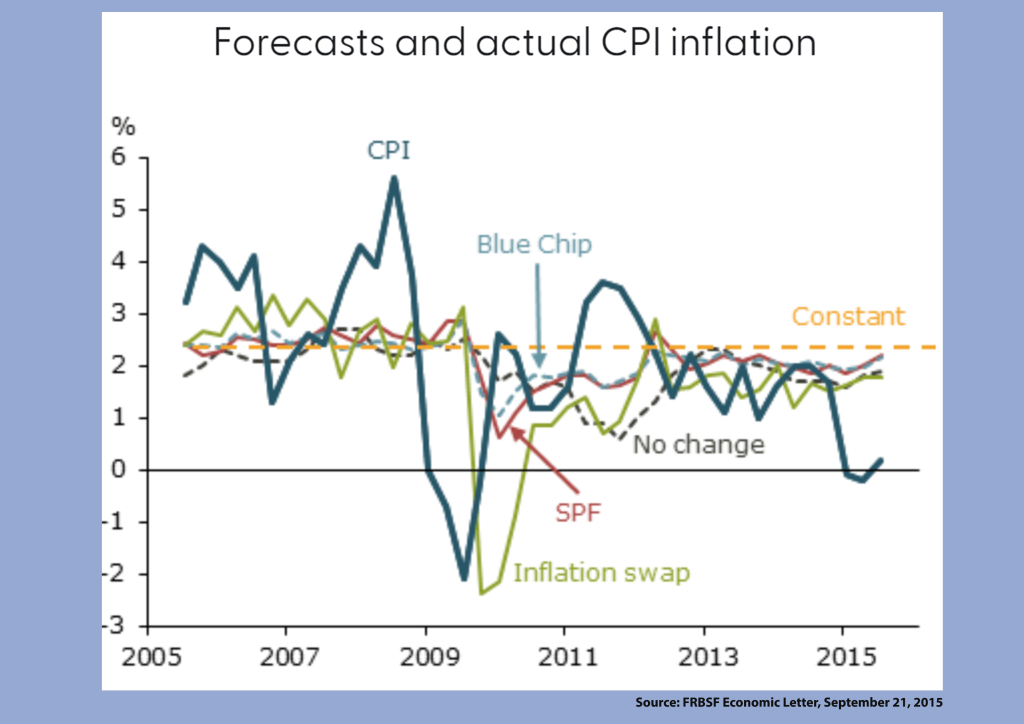

But, Fed indications and the resulting predictions can be inaccurate. The San Francisco Federal Reserve recently published a research report that looked at their various inflation models and the ability to predict future inflation. The average forecast errors were all at least 1.5% across the board, and all missed the mark.

Making investment decisions on near term predictions can be ruinous to a person’s financial success. Many strategists have been recommending to short bonds and to buy gold. These are academically accurate hedging recommendations, but also proving that markets don’t read the textbooks! Recently, bond yields have increased, and gold is down 7.5% YTD.

All of this only reinforces our cornerstone tenet – it is integral to have a long term plan, and the discipline to stick with your plan. We recognize this is difficult, and theorize that this single trait is responsible for more long term wealth creation than any other.

At Cahaba Wealth Management, we are here if you want to discuss your financial plan. Please do not hesitate to reach out with any questions. We appreciate the opportunity to be of service.

Josh Hegland is a financial planning analyst in the Atlanta office and Will Jackson, CFP®, is a partner and financial advisor in the Nashville office of Cahaba Wealth Management, www.cahabawealth.com.

Cahaba Wealth Management is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by the SEC nor does it indicate that the adviser has attained a particular level of skill or ability. Cahaba Wealth Management is not engaged in the practice of law or accounting. Always consult an attorney or tax professional regarding your specific legal or tax situation. Content should not be construed as personalized investment advice. The opinions in this materials are for general information, and not intended to provide specific investment advice or recommendations for an individual. Content should not be regarded as a complete analysis of the subjects discussed. To determine which investment(s) may be appropriate for you, consult your financial advisor.