6/2022

By Brian O’Neill, CFP®

I’ve just returned from a weeklong trip to Ireland with my family. It was rejuvenating in many ways – spending time with my daughter before she goes off to college this fall, talking European soccer with my boys, sharing quiet, peaceful time with my wife that isn’t always possible at home. The only negative was that I missed my dog!

Spending time in Europe always makes me pause and consider the incredible tumult the world has been through, even in the not too distant past. I toured a prison in Dublin where ordinary folks demanding Irish independence from England were detained, and later executed, all for wanting freedom. Ireland only became an independent country in 1922!

As I watched another down week for the markets while on vacation, I also reflected on the rough markets I’ve experienced during my career. The 2000/2001 dot.com bubble was very early on for me, but certainly introduced me to the idea that I wasn’t as smart as I thought. The late 1990s made everyone feel like the best investors in the world, and introduced me to the concept of behavioral biases. If you lived through that period, you’ll also remember a wave of people who quit jobs to become “day-traders” in the market. Just writing that sentence speaks to the hubris that was everywhere in early 2000. Then the S&P 500 declined 49% through October 2002 and the NASDAQ fell over 77%! People weren’t feeling quite as smart when that correction ended.

The Great Financial Crisis of 2008/2009 didn’t quite have the explosive growth in stocks, but real estate took center stage, and people were flipping houses as if they could never lose value. We all know the end of that story.

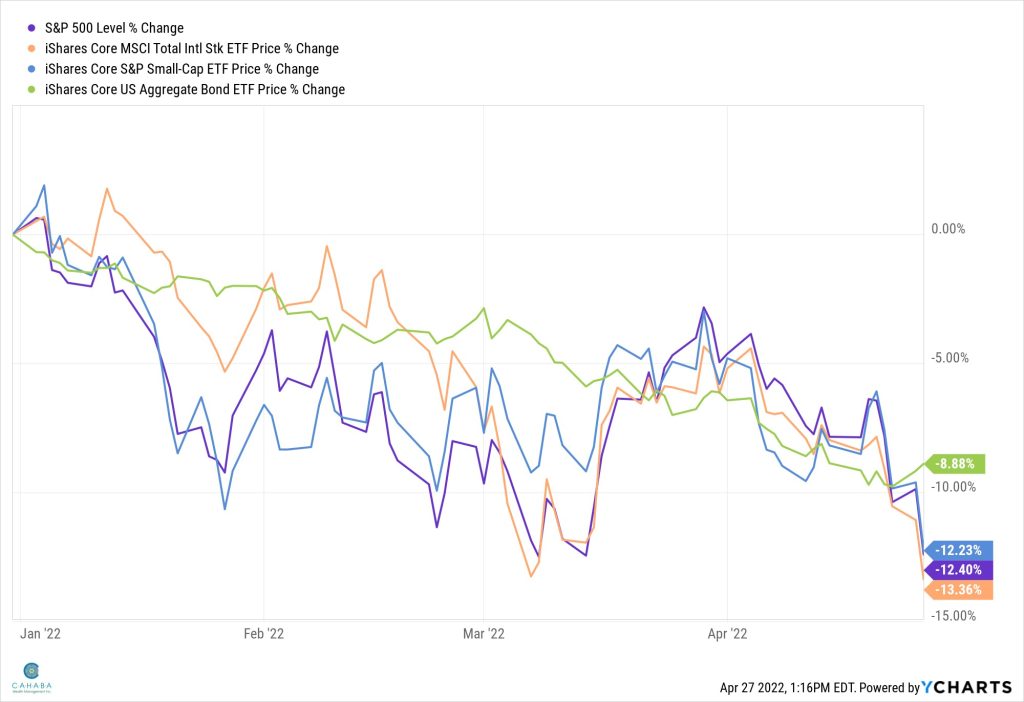

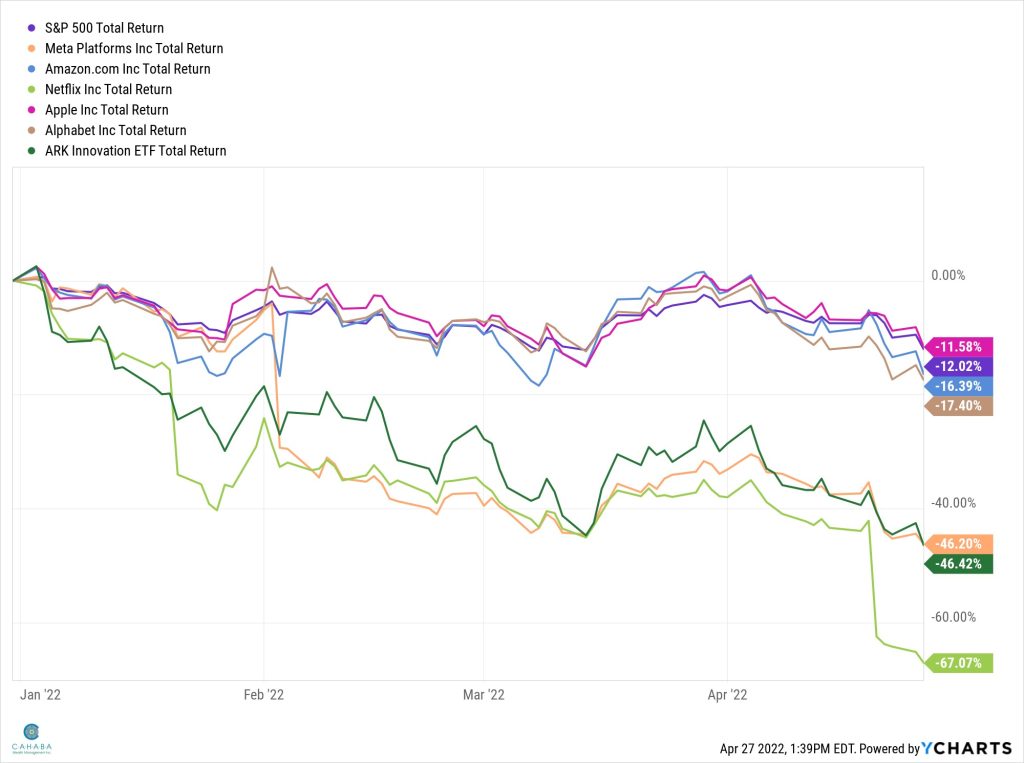

Obviously, the pandemic created different issues. But the end results seemed eerily similar. Investment capital was flowing freely, tech stocks were selling at valuations that reminded me of 2000, Cryptocurrencies created overnight millionaires, and the fear of missing out reared its ugly head again. Investors began to make decisions as if they were smarter than the market. The past few months have wiped out much of that euphoria.

Stock market declines are painful. For many, this one is more painful given a war torn Ukraine, domestic divide and a quick snap in inflation. However, the long gas lines and 16% mortgage rates of the late 70s/ early 80s eventually came to an end, and patient investors with a long term plan were rewarded. Historical turmoil tends to quickly fade from our memory making each bear market seem brand new and permanent. But one central tenet of corrections is that they end. This one will end too. We don’t know exactly when, but the end will come. Having a firm understanding of your long term goals and cash needs during these periods gives a person a significant advantage. It allows the investor to think strategically rather than defensively. For me, it’s another reminder to reflect on how far we’ve come, and to feel confident that a new dawn is just over the horizon.

Brian O’Neill, CFP®, is president and a financial advisor in the Atlanta office of Cahaba Wealth Management, www.cahabawealth.com.

Cahaba Wealth Management is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by the SEC nor does it indicate that the adviser has attained a particular level of skill or ability. Cahaba Wealth Management is not engaged in the practice of law or accounting. Always consult an attorney or tax professional regarding your specific legal or tax situation. Content should not be construed as personalized investment advice. The opinions in this materials are for general information, and not intended to provide specific investment advice or recommendations for an individual. Content should not be regarded as a complete analysis of the subjects discussed. To determine which investment(s) may be appropriate for you, consult your financial advisor.