4/2023

By Don Keeney, CFA, CFP®

Many of us have heard statistics1 claiming:

- Domestic stocks have outperformed international stocks eight out of the last ten years.

- Domestic stocks have outperformed international stocks by a cumulative 20 percentage points over the last three years.

- Domestic stocks have outperformed international stocks by a cumulative 50 percentage points over the last five years.

These truths make it seem as though investing in international stocks is a complete waste of time. To help explain why that’s not the case, let’s take a look at some additional data.

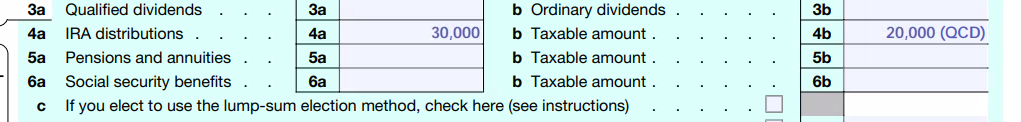

The above chart containing data from 1973 to 2022 outlines the following:

- Over the last 50 years, domestic stocks have outperformed international stocks only 59% of those years.

- International stocks have outperformed domestic stocks 100% of the time when domestic stocks had returns of less than 4% for the year.

- International stocks have outperformed domestic stocks 96% of the time when domestic stocks had returns of less than 6% for the year.

Some of what we hear is rooted in Recency Bias. Recency bias is a behavioral pattern in which people incorrectly believe recent events will soon either occur again or persist indefinitely. This bias inhibits an individual’s ability to objectively gauge probabilities, which can lead to poor decisions. While domestic stocks have outperformed international stocks more recently, this has not consistently been the historical norm – nor can we say it will be the case in all future years. We have to separate recent market occurrences from future anticipated market movements.

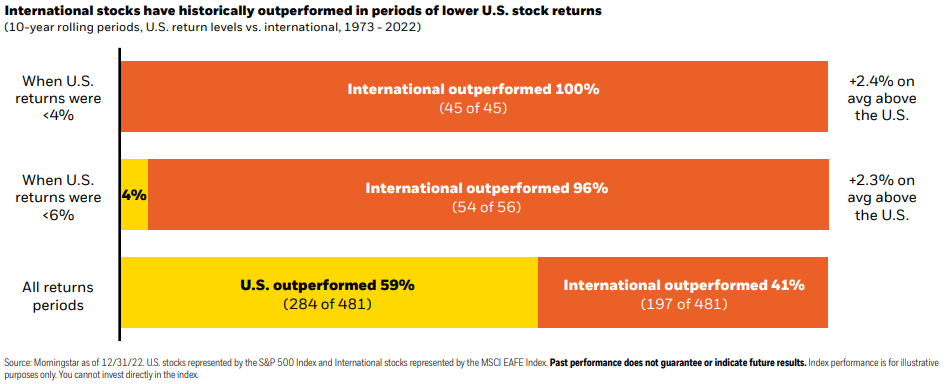

There is solid evidence that shows the outperformance of one stock market over the other occurs in long cycles (see figure 2). The current cycle is now over 12 years long (including 2023 year-to-date). However, immediately before the current cycle started, international stocks outperformed domestic stocks for roughly eight consecutive years. While the below graphic consists of 5-year rolling returns and not stand-alone calendar years, the perspective remains meaningful. The current cycle is not going to last forever. Investors should acknowledge recency bias and expect the market to NOT stay that way.

When is the next cycle going to start? Who knows! Was international’s outperformance in 2022 the start of a new, long-term outperformance cycle? Who knows! Only one thing remains certain: at some point, the current performance cycle will flip, and international stocks will outperform domestic stocks (at least until the next cycle begins).

With this in mind, Cahaba Wealth Management appropriately constructs your investment portfolio to maximize the potential return for an appropriate amount of risk over the long term. The conversation above about which asset class is going to outperform another asset class actually misses the bigger, more important idea at play: diversification. Diversification is the process of spreading your investments around to multiple different asset classes so that your exposure to any one type is limited. As we tell our clients, diversification is the only “free lunch” in investing!

In other words, an investor can purchase two (or more) risky assets and simultaneously (1) improve the expected rate of return for the combined portfolio AND (2) reduce the portfolio’s overall expected risk. Diversification is a true “two-for-one special”! The only caveat is that the assets cannot act exactly like each other – meaning the assets should not have the same performance and volatility patterns. The more dissimilar the returns are, the larger the “free lunch”.

The takeaway is not to ask if international stocks will ever outperform domestic stocks again (or vice-versa); instead, it is to capitalize on the value of diversification and the resulting higher expected returns, with lower volatility, over your long term investing horizon. The inclusion of temporarily underperforming asset classes will always remain a positive contributor to your portfolio, given the power of diversification!

Don Keeney, CFA, CFP® is a financial advisor in the Nashville office of Cahaba Wealth Management, www.cahabawealth.com.

Cahaba Wealth Management is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by the SEC nor does it indicate that the adviser has attained a particular level of skill or ability. Cahaba Wealth Management is not engaged in the practice of law or accounting. Always consult an attorney or tax professional regarding your specific legal or tax situation. Content should not be construed as personalized investment advice. The opinions in this materials are for general information, and not intended to provide specific investment advice or recommendations for an individual. Content should not be regarded as a complete analysis of the subjects discussed. To determine which investment(s) may be appropriate for you, consult your financial advisor.

1Source: ycharts.com