8/2022

By Chris Conkell, CFP®

The first half of 2022 has been painful for investors. The laundry list of worries continues to mount as we stumble through the aftermath of a global pandemic. This year’s sleepless nights are brought to you by the highest inflation rate in forty years, a war in Europe, spiking interest rates, a bear market in stocks, and rapidly declining consumer sentiment.

You would not be human if you didn’t experience some degree of fear at the direction of current events. As trusted guides, our mission is to help clients look past temporary headlines and maintain a relentless focus on long term planning. This largely boils down to controlling the controllables – what follows is a list of actionable steps you can take to ride out the storm:

- Choose to Play Long-Term Games

Rather than succumb to fear and emotion, understand that bear markets and recessions are part of every investor’s lifecycle. View them as necessary speed bumps on the road to capturing long term returns that will fund future lifestyle needs, dreams, and objectives. Ben Carlson writes in his book, A Wealth of Common Sense:

“Over decade-long time horizons, your investment performance will mainly be derived from how you handle corrections, bear markets, and market crashes. During every single bear market there will be times when you wonder if the losses will ever stop. You will always wonder how much lower the market can go. The economic news will be terrible. Other investors around you will be depressed. Pessimism becomes pervasive.”

Not getting scared out of your portfolio is half the battle, and our directive is to help clients stick to their financial plan.

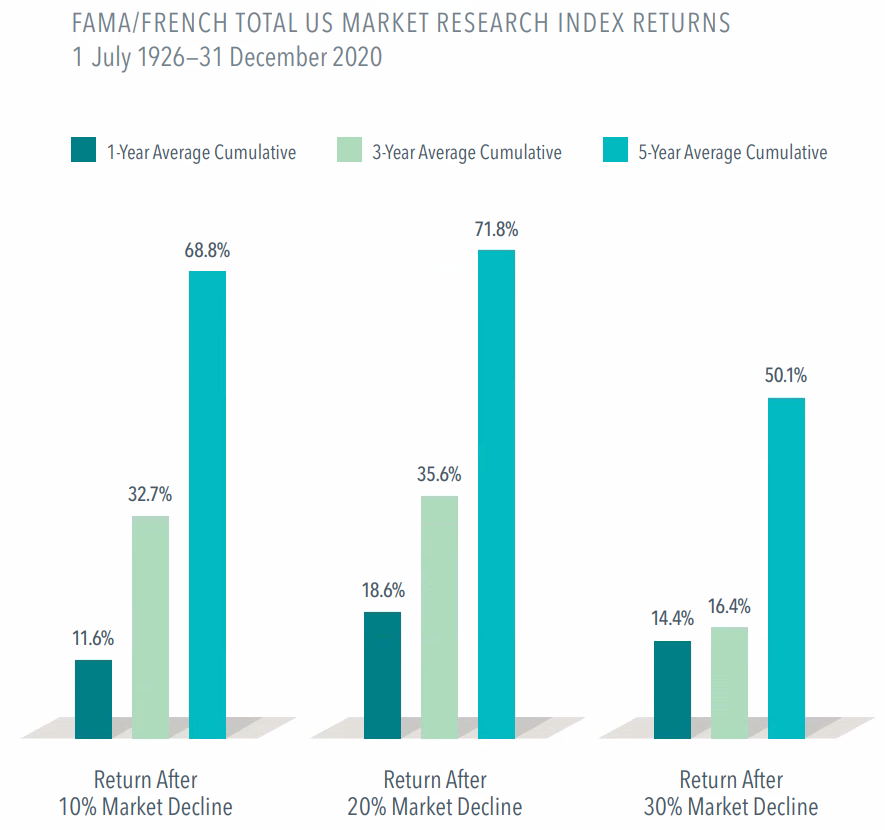

- Keep Buying

Bear markets provide an opportunity to buy stocks at lower prices. This includes workers making regular payroll contributions to retirement plans, investors with excess cash to deploy, and even retirees who can opportunistically rebalance their portfolios. While it’s impossible to know how long it will take for markets to recover, a review of the historical record offers a dose of optimism. Below is a look at broad-market U.S. stock returns following steep market declines since 1926:

- Harvest Your Losses

Given the decline in both stocks and bonds this year, some investors might have unrealized losses in portions of their non-retirement portfolios. By strategically selling these investments and replacing them with highly correlated alternatives, you can book losses to offset tax liabilities (while maintaining your target asset allocation). As the saying goes, when life gives you lemons…

- Consider a Roth IRA Conversion

Although caveats abound within this complex planning technique, generally speaking, the cost of Roth conversions are discounted during market declines. To recap, Roth IRAs offer tax-free appreciation and withdrawals, and unlike traditional IRAs, required minimum distributions are not mandated when account owners turn 72. Roth conversions executed in bear markets are especially enticing, as future gains will be tax-free when the market rebounds. Given the complexity and reliance on your current tax bracket, we strongly recommend discussing the merits of this strategy with your financial planner.

- Plan!

There are many aspects of a comprehensive financial plan that can be addressed away from the high stress theater of the 24/7 financial news cycle. Several suggestions include:

- Review your estate plan and beneficiary designations to ensure your wishes are reflected appropriately.

- Confirm insurance coverage amounts are sufficient for life, disability, property and casualty, etc. For example, home values have increased significantly of late, so make sure your replacement coverage is accurately reflected.

- Review household budget/lifestyle to accurately gauge personal inflation rate.

Although successful investing during bear markets will largely be defined by what you choose to ignore, there are plenty of actionable steps you can take to meaningfully improve your financial household. We’re here to talk about your plan, and appreciate the opportunity to be of service!

Chris Conkell, CFP®, is a financial advisor in the Atlanta office of Cahaba Wealth Management, www.cahabawealth.com.

Cahaba Wealth Management is registered as an investment adviser with the SEC and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by the SEC nor does it indicate that the adviser has attained a particular level of skill or ability. Cahaba Wealth Management is not engaged in the practice of law or accounting. Always consult an attorney or tax professional regarding your specific legal or tax situation. Content should not be construed as personalized investment advice. The opinions in this materials are for general information, and not intended to provide specific investment advice or recommendations for an individual. Content should not be regarded as a complete analysis of the subjects discussed. To determine which investment(s) may be appropriate for you, consult your financial advisor.