12/2022

By William Jackson, CFP®

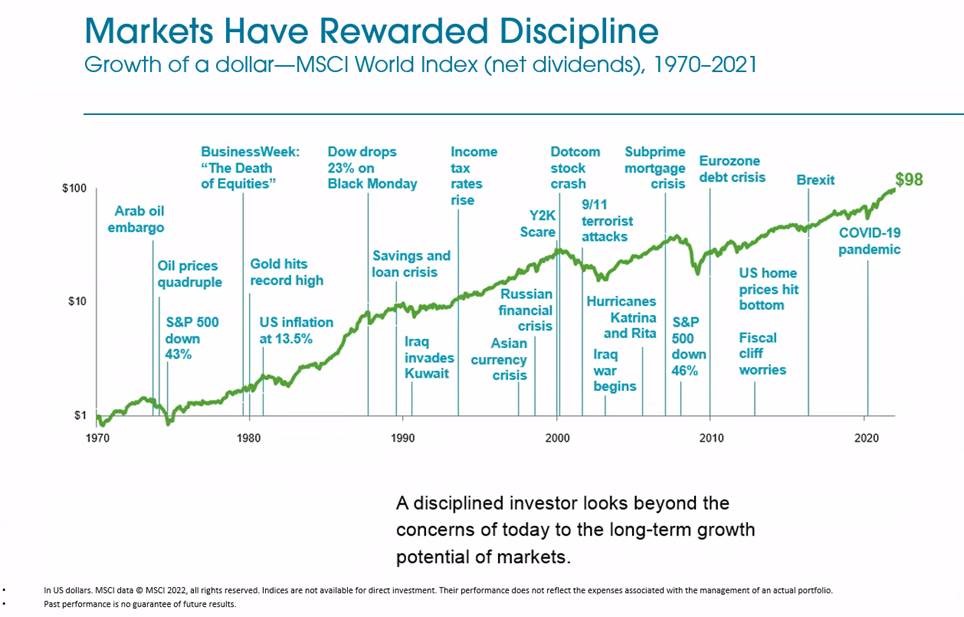

When discussing successful wealth management, most will typically include investment management/asset allocation, cash management, risk management, and other predictable factors. What is typically omitted or minimized relates to behavioral psychology. How one reacts to adversity is arguably more impactful to long-term success than all the other factors combined. Specifically, having the courage to stay the course during uncertain times is often the greatest determinant of long term success.

Holistic financial planning permits a good advisor to focus every conversation on the client’s long term plan. This approach enables the advisor to provide a service that truly helps clients lead their lives with greater financial clarity. The challenge is that we work in an industry that is intentionally opaque. Having a plan and staying the course is not standard operating procedure for the majority of industry participants. These firms have a strategy of offering reactionary products to clients that attempt to solve the problem of the day. They bombard our inboxes with updates to make us aware of solution “de jour”. Frequently, these products are of a complex nature, and render the buyer feeling underqualified to understand but worried about missing out. These firms are well aware that when clients are overwhelmed with “over their head” concepts, they might feel hesitant to ask questions. This ultimately results in many clients agreeing to purchase products that are often unnecessary or even inappropriate for their personal plans. A good advisor who is “fee-only” and focused on financial planning serves as an agent of clarity with the mission of helping clients understand why any products chosen for them are beneficial and necessary. This might sound simplistic, but the rewards are real.

The foundation of Cahaba Wealth was built on knowing our clients and their financial goals. We provide comprehensive financial planning in a way that leads clients to have greater understanding of their financial lives. The financial plan dictates the investment plan. The investment plan and process are intentionally designed to encourage a discipline that has shown to be beneficial to long term wealth creation. In asking you to trust in the process and have the courage to take a road less traveled, we are demonstrating our commitment to your success. We are aware of the magnitude of this request and are grateful for the faith shown.

Eleanor Roosevelt wrote, “You gain strength, courage and confidence by every experience in which you really stop to look fear in the face. You are able to say to yourself, ‘I have lived through this horror. I can take the next thing that comes along.’ You must do the thing you think you cannot do.”

We are proud to call you clients and thankful for the opportunity to serve.