How We Work

Almost always, wealth isn’t found overnight. For most, it’s earned over time by a having a solid plan that allows you to accumulate wealth for the future. Our goal is to engage you in the process of planning: a regular, ongoing activity that will help you make informed decisions today to better shape and prepare you and your family for the future.

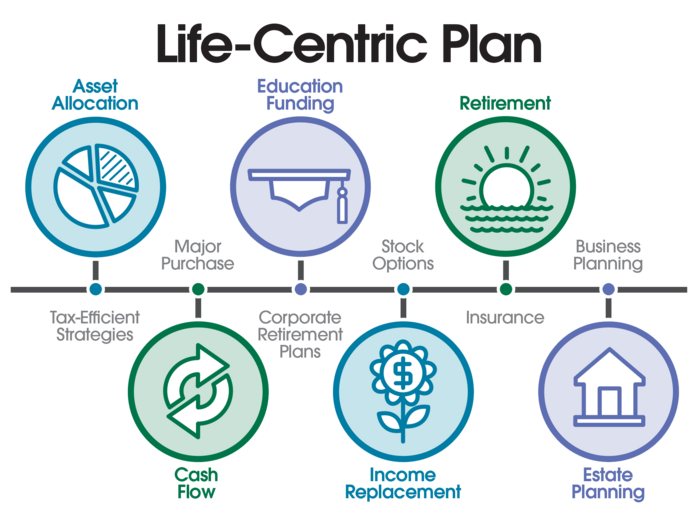

We have conversations about what really matters to you. Our planning process begins by listening to your needs rather than asking about your assets. We work to bring together your life, your family, your business and your money in one Personalized Life-Centric Plan.

Our Process

Data Gathering

We always start with you. We learn about you and your family, your needs, your goals for the future. We ask about your objectives, risk tolerance, financial concerns and time horizon so we can develop a road map to help you achieve your goals. Central to our process is our personalized planning software which enables us to formulate strategic investment recommendations based on your unique situation.

Personalized, Life-Centric Plan

Your Cahaba team, including your advisor, a dedicated paraplanner and assistant, will work to deliver a written financial plan and summary of your key areas of focus. We’ll review a detailed checklist of items necessary to implement our investment recommendations and planning solutions.

Portfolio Construction

We move forward by creating an investment portfolio that aims to generate the best possible return for your personal level of risk. Our knowledge of your comprehensive financial plan, in conjunction with your risk tolerance informs your asset allocation strategy and the selection of specific investments for your portfolio.

Monitoring & Review

Your financial plan is a living document that requires ongoing monitoring, flexibility and review. To keep your plan up to date, we create a check list, meeting schedule and are proactive in completing all of your important action items. We act as a financial facilitator and coordinate regularly with your other trusted advisors, such as your CPA, lawyer and estate planning attorney.